Last hurrah for Richmond borough house prices?

By The Editor 18th Dec 2022

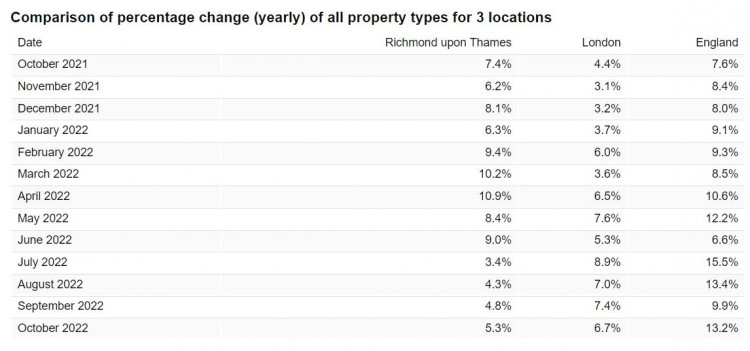

Average sale prices for homes in Richmond were up by 5.3% in October compared to the year before, according to the latest official figures from the Office for National Statistics. (ONS)

The annual rise in the borough was below the 6.7% seen for London as a whole and 13.2% for England.

Property experts say the increase was the last before the market and borrowing costs were thrown into turmoil by the disastrous mini-Budget of Liz Truss and her Chancellor Kwasi Kwarteng.

The borrowing costs on mortgages, particularly long term fixed rate deals running to two and five years, rose sharply. At the same time, the Bank of England is further pushing up the base rate and borrowing costs.

Estate agents reports that a number of buyers have pulled out of the market because they cannot afford higher mortgage repayments. At the same time, asking prices appear to be coming down, which suggests sale prices will also dip down through the winter and into the New Year.

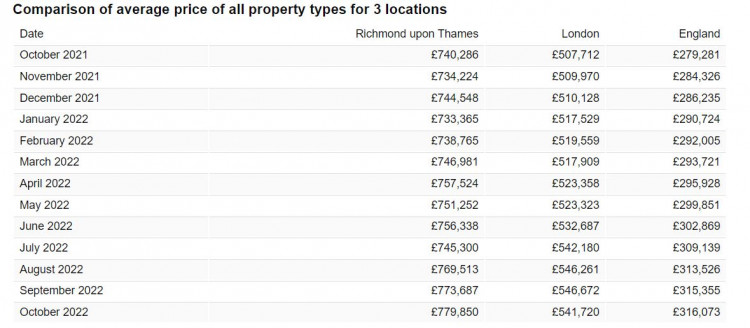

The official figures published by the ONS and Land Registry put the average sale price across all property types for Richmond borough at £779,850 in October, which was up by 5.3% from £740,286 in the same month in 2021.

Looking at specific property types –

* Average sale price for detached properties was £1,722,865, which up 4.4% from £1,650,154.

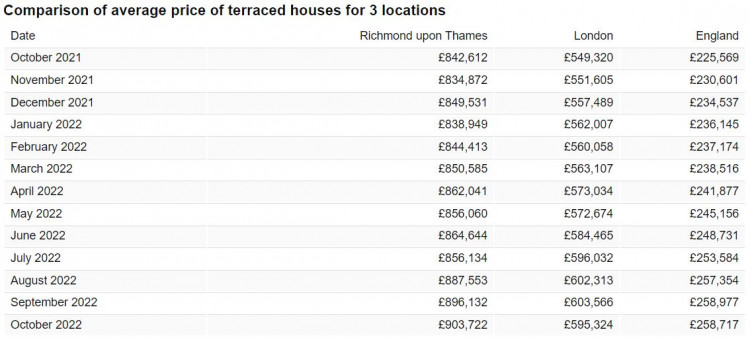

* Average sale price for terraced properties was £903,722, which was up 7.2% from £842,612.

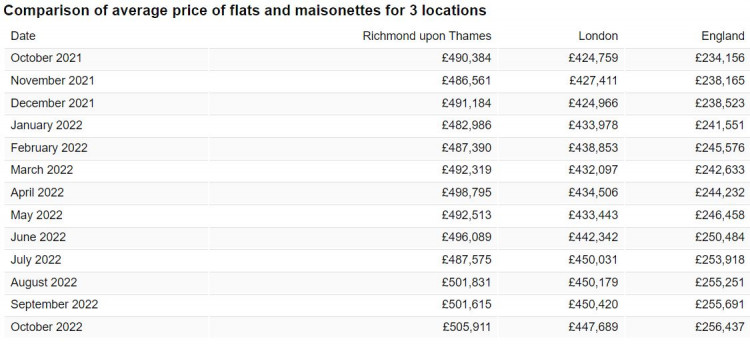

* Average sale price for flats and maisonettes was £505,911, which was up 3.2% from £490,384.

Chief Economist at the Royal Institution of Chartered Surveyors, Simon Rubinsohn, said the organisation's surveys of members paints a downbeat picture 'reflecting the uncertain macro environment and the higher cost of mortgage finance'.

He said falls in asking prices will extend through the coming months. However, he said: "The likely 'job-rich' recession suggests the downturn in the housing market this time could be shallower compared with past experiences."

Nicky Stevenson, Managing Director at national estate agent group Fine & Country, said: "Unprecedented volatility in the mortgage market following the mini-budget was not enough to derail the housing market in October.

"However, with the Bank of England forecast to announce a ninth hike in interest rates shortly, the outlook may be less rosy in the future.

"Increased borrowing costs and tax rises mean buyer affordability is being stretched to the limit, and there is growing evidence of asking prices starting to trend downwards.

"While no one can predict with any certainty where house prices will go from here, there is little doubt that there are challenging times ahead for buyers and sellers alike."

CHECK OUT OUR Jobs Section HERE!

teddington vacancies updated hourly!

Click here to see more: teddington jobs

Share: