Can the borough survive property market storm? – Sale prices rose in the Spring

By Rory Poulter 25th Jun 2023

Borough house prices held up during the Spring despite the gathering clouds caused by surging interest rates.

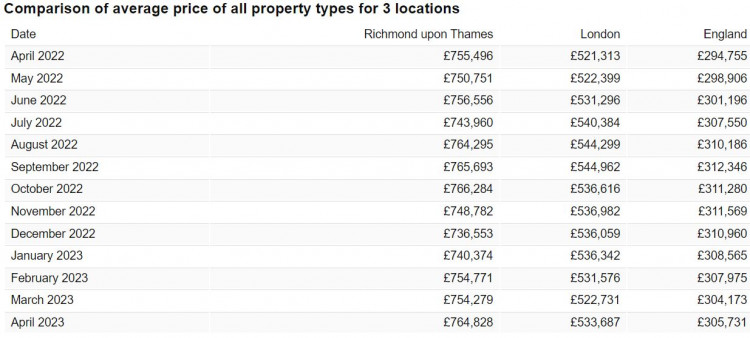

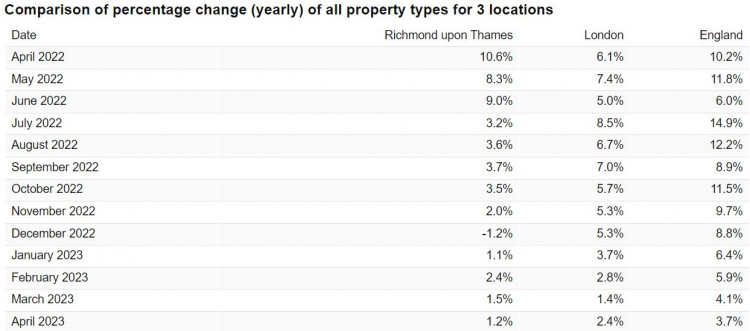

The average sale price across all property types was £764,828, according to figures published this week by the Office for National Statistics and Land Registry.

The figure was up by more than £10,000 on March and represented an annual increase of 1.2 per cent.

The data is less current than other housing market surveys, however it is the most reliable as it measures what properties actually sold for.

Local estate agents say the market has been propped up to some extent by the arrival of wealthy buyers from Hong Kong, who have been attracted to Richmond after taking advance of a government special visa scheme.

At the same time, the Richmond property market stands out for the fact that a number of supersize mansions with asking prices in excess of £5m are currently available.

However, property market analysts believe the entire UK housing market faces turmoil and, potentially, substantial price falls on the back of soaring interest and mortgage rates.

A decision by the Bank of England to push up the base rate by 0.5 of a percentage point to 5 per cent, is predicted to push rates on new two-year fixed rate home loans towards 7 per cent. That will add hundreds of pounds to monthly repayments for people who are due to remortgage in the coming months.

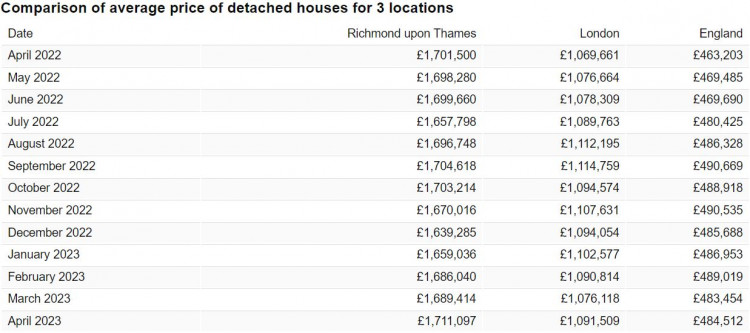

The ONS data for Richmond for April shows the average sale price achieved by detached homes was £1,711,097, which was up by around £3,000 on the month before.

The figure for terraced properties was £876,407, which was up by around £12,000 on March. While the average sale price for flats and maisonettes was £499,486, which was up more than £7,000 in a month.

Looking ahead, mortgage expert at Quilter, Karen Noye, said some people carrying big mortgages may have to sell up when faced with big increases in monthly repayments.

"There are plenty of people who will have overstretched themselves and there is very little that can be done and will sadly have to sell their properties,' she said.

"If there is a flood of properties on the market at a time when demand is dampened because of budgetary concerns, then naturally house prices will start to shrink.

"We have seen huge turbulence in the mortgage market over the past week or so with lenders withdrawing products with next to no notice.

"The only thing that people looking to secure a deal at this time can do is get all the relevant documentation over to your lender or mortgage adviser as quick as possible to avoid you losing the deal and ultimately having to find another or pay more when the same product is put back on the market at a higher rate."

CHECK OUT OUR Jobs Section HERE!

teddington vacancies updated hourly!

Click here to see more: teddington jobs

Share: